malaysia road tax rate

RM274 base rate Remaining 10kW. Total road tax.

So minus 1600cc instead of 1601cc.

. Finding an EV that is large and practical enough to be a main vehicle but has a low enough power output to avoid progressive road tax charges will impossible. List the price range according to these different factors and link externally to the JPJ website. Take for example the Isuzu D-Max The 30-litre version is more popular in East Malaysia compared to West Malaysia.

Road Tax for Commercial Vehicles JPJ. LKM Rates Calculation Guidelines for Electric Vehicles. The road tax Porsche Taycan Turbo S locally for instance costs a hefty RM 12094 every year while Malaysians with a dream of owning a lightning-fast Tesla Model S Plaid will be starring down the barrel of an annual road tax bill that totals RM 17862.

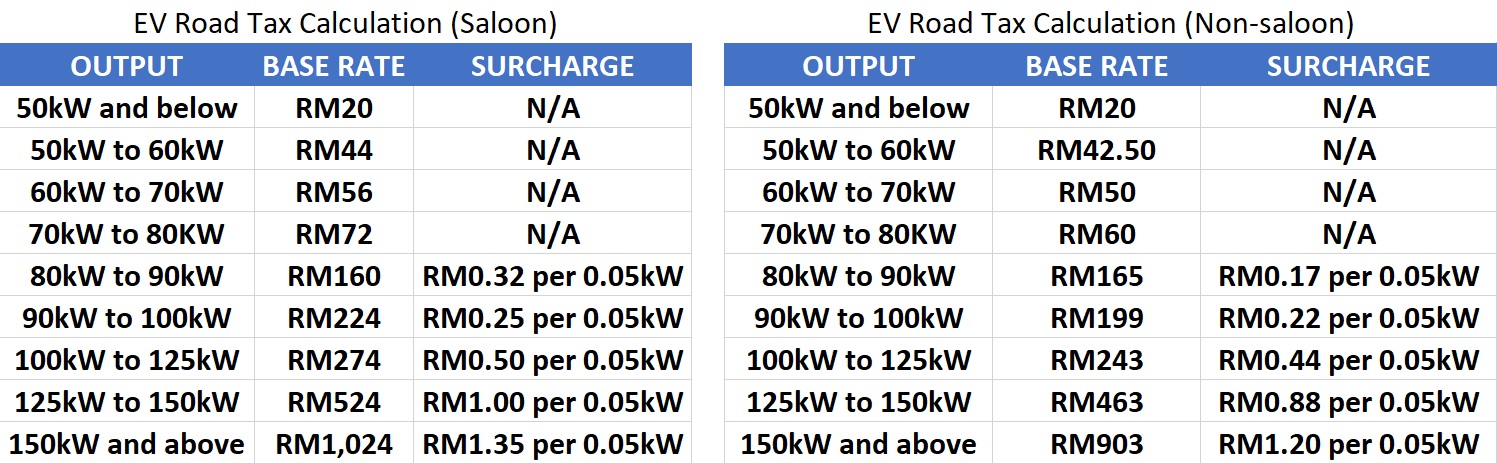

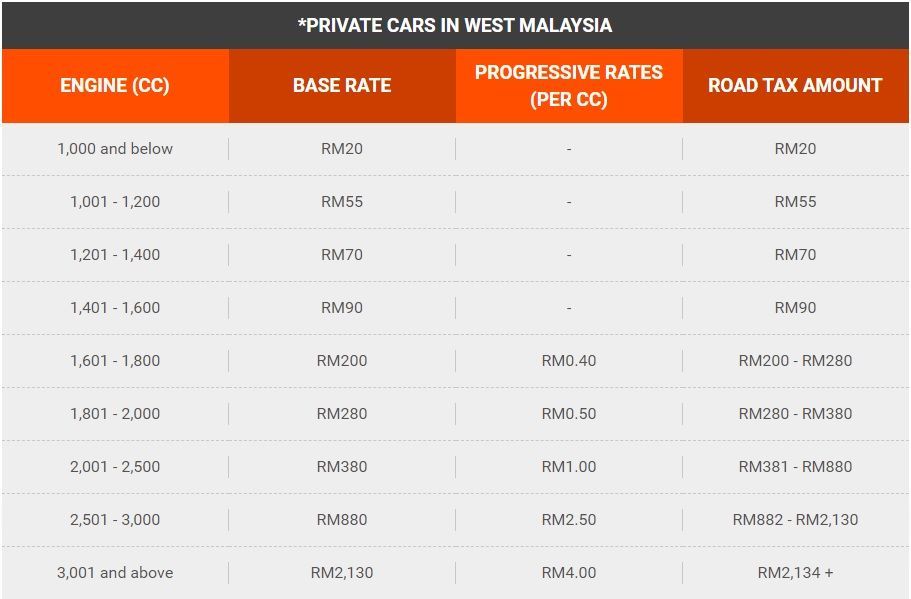

The larger a vehicles engine the more road tax is payable. Nur Adilah September 14 2021 It is mandatory for every car owner in Malaysia to have a valid Motor Vehicle License LKM or roadtax to legally drive on Malaysian public roads. For electric cars having output up to 80 kW the road taxes are The electric cars which produce more than 80 kW of output the rates are - Electric motorbikes The road tax on electric motorcycles in Malaysia is fixed at RM 2 for vehicles having an output rating of 75 kW.

Total of progressive rates Base Rate. Road Tax for Commercial Vehicles. On April 1 1946 the Road Transport Department was set up to.

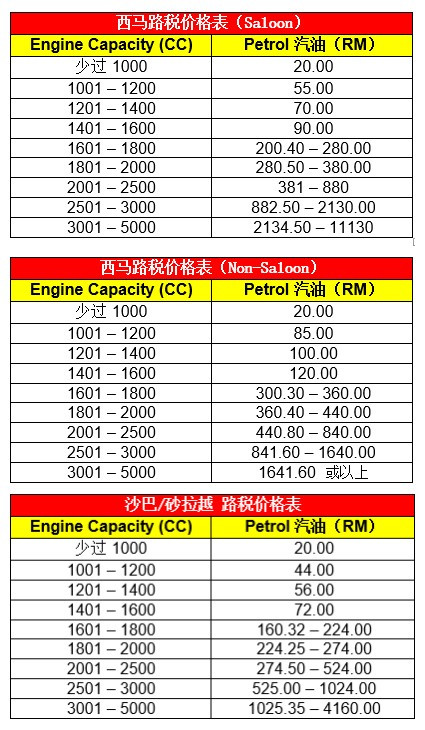

Road tax is even cheaper for cars in East Malaysia for both saloon and non-saloon cars. EV Road Tax Calculation In Malaysia For EV Saloons Compacts MINI Cooper SE 135 kW 183 PS Take the MINI Cooper SE or example which has a maximum power output of 135 kW the road tax is RM 724 calculated with the above method. Using the same formula if the engine capacity is 1599 cc it would be fixed that the road tax is RM90 per year.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. So this puts your car into the 100kW 125kW bracket for the road tax. Rates calculation guidelines for Electric Vehicles.

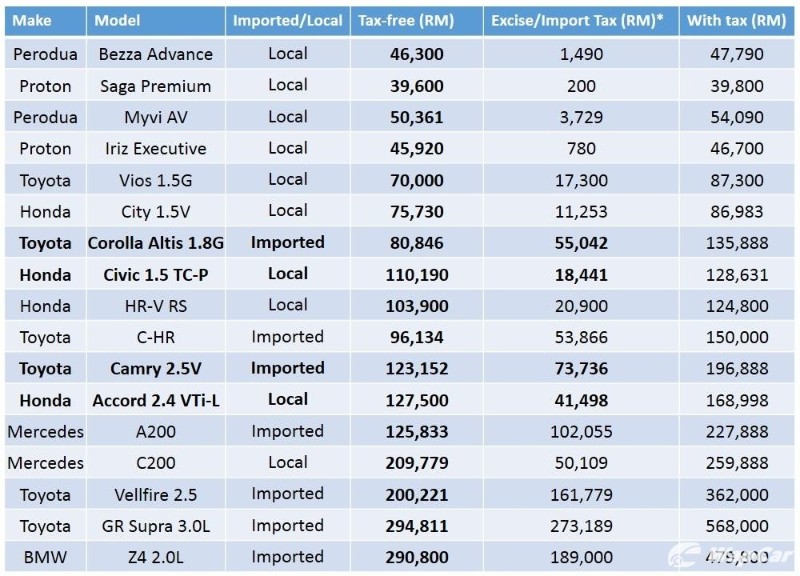

In Malaysia car insurance is compulsory and road tax also has to be paid by car owners. Even for those who decide in opting for a more humble set of eco-friendly wheels meanwhile. Import duty must be paid on any vehicles imported into Malaysia.

These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Your road tax amount. Road Tax for Public Transport.

And that is how you can calculate the amount of your road tax yourself. For a non-saloon vehicle namely an MPV an SUV or a pick-up. Do note that recently in Malaysias Budget 2022 the government has announced that there will be tax-free incentives for EV cars inclusive of road tax.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. We share in this article the latest roadtax prices in Malaysia for a range of car brands and models. Above 16L Cars that are above 16L or 1600cc will be charged to a maximum of RM200 per vehicle.

Above 80 kW to 90 kW RM160 and RM032 sen for every 005 kW 50 watt increase. For this category it does not matter if its private or company-owned. At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc and below.

Above 125 kW to 150 kW RM524 with RM100 for every 005 kW increase from 125 kW So it is RM524 RM200 RM 724. The progressive rate increases as the engine displacement increases. Progressive rate is capped at RM160 per cc only from 2500 cc onwards while a privately registered saloon car can be levied up to RM450 per cc from 3000 cc onwards.

It gets charged a base rate of RM6010 and an additional RM1350 for each cc in excess of 3000 cc amounting to exactly RM54502. Above 75 kW the rate is calculated as per the following. MPV SUV or pickup trucks are classified as non-saloon vehicles and need to pay a different rate.

Roadtax EN Written by. Yearly Repayment RM 9000. Car roadtax prices vary across cars.

RM841 - RM1650. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase. Like how we mentioned previously its important to pay your road tax on time.

NEW Road Tax rates for EVs in Malaysia For the past few years Electric Vehicles EV like the Tesla Nissan Leaf and Renault Zoe have been enjoying a very low road tax rate as the Malaysian road transport department did not see a need to look throughly into this segment as there were so few EVs running around. Road Tax Calculator - otomy Car Loan Calculator Insurance Calculator Road Tax Calculator Car Market Value Guide Road Tax Calculator Latest JPJ formula - calculate how much your vehicles road tax will cost. Road Tax Calculator Latest JPJ formula - calculate how much your vehicles road tax will cost.

One result of this lower road tax in East Malaysia is having bigger displacement variants of cars selling better in East Malaysia. SUVMPVPick-up in East Malaysia road tax. Engine cc Base Rate.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak revised after the 2009 Budget. On the other hand if the car is just 1 cc above 1600 which is 1600cc then the annual road tax would be RM20040. RM7960 RM200.

Given its a hatchback the Leafs base road tax would cost RM243 per year plus another RM88 in progressive charges bringing its total to RM331. RM050 progressive rate x 200 RM100. To calculate the road tax of a vehicle the base rate and progressive rate will have to be combined.

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Topgear The Bmw Ix Will Cost You Rm3 063 Per Year In Road Tax Here S Why

Car Road Tax Calculator In Malaysia Wapcar

Everything You Need To Know About Road Tax Renewal Online In Malaysia

Diesel Vs Petrol Cars Pros And Cons Mytukar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Why Is The Road Tax Cheaper In Sabah And Sarawak Paultan Org

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

Isuzu Malaysia Reveals 0 Gst Prices Autoworld Com My

Road Tax给多少 当然要看你买什么车啦 大马汽车路税大全 你要还rmxxx 铁饭网 Ricebowl My

接近更新路税road Tax的日期了吗 来查看更新大马汽车road Tax的费用 赶紧学起来 2019 Paris Star

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

Why Is The Road Tax Cheaper In Sabah And Sarawak Paultan Org

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Comments

Post a Comment